Tax Specialist

Moulton RB Corp.

Job Description

Benefits

Government Mandated Benefits

13th Month Pay, Pag-Ibig Fund, Philhealth, SSS/GSIS

Job Summary:

The Tax Specialist will support clients in managing their tax compliance, accounting, and financial reporting responsibilities. This role requires a deep understanding of Philippine tax laws and regulations, accounting practices, and the ability to provide clients with expert guidance in tax planning, reporting, and preparation. The Tax Specialist will work directly with clients to ensure compliance and optimize their tax positions.

Key Responsibilities:

- Tax Compliance: Ensure clients comply with all applicable tax regulations in the Philippines, including the Bureau of Internal Revenue (BIR) requirements. Prepare and file tax returns such as Income Tax, Value-Added Tax (VAT), Withholding Tax, and other required returns within deadlines.

- Tax Reporting: Prepare monthly, quarterly, and annual tax reports for clients, ensuring all financial statements reflect accurate tax calculations.

- Tax Advisory: Provide advice on tax strategies, deductions, and credits available to clients to minimize their tax liabilities while adhering to legal requirements. Advise clients on tax implications of transactions, investments, and business decisions.

- Tax Planning: Assist clients in planning and optimizing their tax positions to ensure efficient tax structures, taking into consideration both short-term and long-term financial goals.

- Tax Audits & Investigations: Represent clients during BIR audits and investigations, working closely with the tax authorities to resolve discrepancies or disputes. Prepare responses and supporting documentation as necessary.

- Tax Documentation & Filing: Maintain accurate and up-to-date records for tax filings and ensure that all tax-related documents are properly filed, stored, and easily accessible for audits or inquiries.

- Accounting Support: Work closely with the accounting team to ensure that tax-related accounting entries are accurate and compliant with accounting standards and tax laws.

- Client Liaison: Communicate with clients to address tax-related concerns, resolve issues, and provide insights on tax matters affecting their business operations.

- Continuous Learning & Development: Stay updated on changes to tax laws, regulations, and best practices in tax accounting in the Philippines. Participate in professional development activities and training.

Qualifications:

- Education: Bachelor’s degree in Accountancy, Finance, or Taxation. A master’s degree or a relevant professional certification is an advantage (e.g., Certified Public Accountant (CPA), Taxation Certification).

- Experience: Minimum of 2-3 years of experience in tax compliance, tax advisory, and accounting, preferably within an accounting firm or a corporate tax department.

- Skills & Competencies:

- Strong knowledge of Philippine tax laws and the BIR filing system, including income tax, VAT, tax treaties, and withholding tax.

- Proficiency in accounting software and tax preparation tools (e.g., QuickBooks, Xero, BIR e-filing).

- Excellent analytical, problem-solving, and organizational skills.

- Strong communication skills in both English and Filipino to interact effectively with clients, tax authorities, and internal teams.

- Attention to detail and ability to manage multiple deadlines efficiently.

- Ability to provide clear, concise tax advice and guidance to clients.

- Ability to work under pressure and handle sensitive financial data with discretion.

Certifications (preferably but not required):

- Certified Public Accountant (CPA) or Taxation Certification.

- Additional certifications such as Master in Taxation or training in tax law are an advantage.

HR Tin

HR ManagerMoulton RB Corp.

Reply 0 Times Today

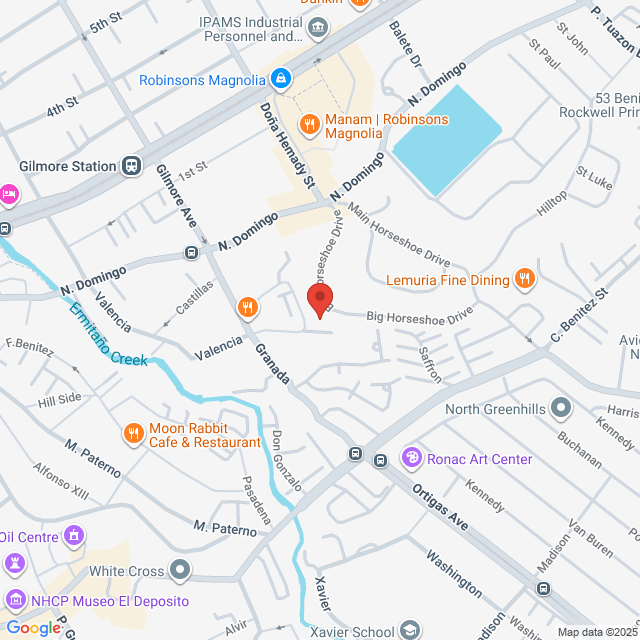

Working Location

37 1ST STREET NEW MANILA, 60b Valencia, Quezon City, Metro Manila, Philippines

Posted on 11 December 2025

Explore similar jobs

View more similar jobsTax Compliance Specialist - Urgent

Metro Tiles Inc.

Metro Tiles Inc.$399-486[Monthly]

On-site - Quezon City3-5 Yrs ExpBachelorFull-time

Christine SagunHR Assistant

Tax Specialist

Moulton RB Corp.

Moulton RB Corp.$434-607[Monthly]

On-site - Quezon City1-3 Yrs ExpBachelorFull-time

HR TinHR Manager

Accounting SpecialistUrgent

J Essentialz Marketing Corporation

J Essentialz Marketing Corporation$347-434[Monthly]

On-site - Quezon City1-3 Yrs ExpBachelorFull-time

Abet RullHR Manager

Tax Specialist

Benby Enterprises, Inc.

Benby Enterprises, Inc.Negotiable

On-site - Quezon City<1 Yr ExpBachelorFull-time

Joana Mae RiveroTalent Acquisition Partner

Tax Associate

Field Outsource Asia Inc

Field Outsource Asia Inc$260-434[Monthly]

On-site - Quezon City<1 Yr ExpDiplomaFull-time

Adrian BelloHR Officer

Sign In to Chat with Boss

Bossjob Safety Reminder

If the position requires you to work overseas, please be vigilant and beware of fraud.

If you encounter an employer who has the following actions during your job search, please report it immediately

- withholds your ID,

- requires you to provide a guarantee or collects property,

- forces you to invest or raise funds,

- collects illicit benefits,

- or other illegal situations.