Accountant

Miltec Trading

Job Description

Benefits

Government Mandated Benefits

13th Month Pay, Pag-Ibig Fund, Philhealth, SSS/GSIS

We are seeking a detail-oriented and knowledgeable Certified Public Accountant (CPA) specializing in tax to join our team. The ideal candidate will be responsible for managing all aspects of tax compliance, planning, and reporting for individuals, corporations, and partnerships. This role requires strong technical tax knowledge, analytical skills, and a commitment to providing exceptional client service.

Key Responsibilities:

Tax Compliance:

• Prepare and review federal, state, and local income tax returns for individuals, corporations, partnerships, and trusts.

• Ensure timely and accurate filing of all tax documents in compliance with applicable laws and regulations.

• Assist with IRS and state tax audits, responses to tax notices, and correspondence.

Tax Planning & Advisory:

• Provide proactive tax planning strategies to minimize tax liabilities for clients.

• Advise clients on the tax implications of business decisions, investments, and transactions.

• Stay up to date with changes in tax laws and regulations and interpret how they impact clients.

Accounting & Reporting:

• Assist in the preparation of year-end financial statements and tax provision calculations.

• Collaborate with finance and accounting teams on tax-related journal entries and reconciliations.

• Support clients with estimated tax payments and payroll tax compliance.

Client Management:

• Maintain strong relationships with a portfolio of clients and serve as a trusted tax advisor.

• Clearly communicate complex tax matters to clients in an understandable way.

• Identify opportunities for additional services and collaborate with internal teams to deliver solutions.

Qualifications:

• Certified Public Accountant (CPA) license required.

• Bachelor’s degree in Accounting, Finance, or a related field (Master’s in Taxation is a plus).

• Minimum 3–5 years of experience in public accounting or corporate tax.

• In-depth knowledge of U.S. federal and state tax laws and compliance procedures.

• Experience with tax software (e.g., UltraTax, ProSeries, Lacerte, CCH Axcess, or similar).

• Strong proficiency in Microsoft Excel and general ledger systems (e.g., QuickBooks, NetSuite).

Grace Montano

HRMiltec Trading

Reply 0 Times Today

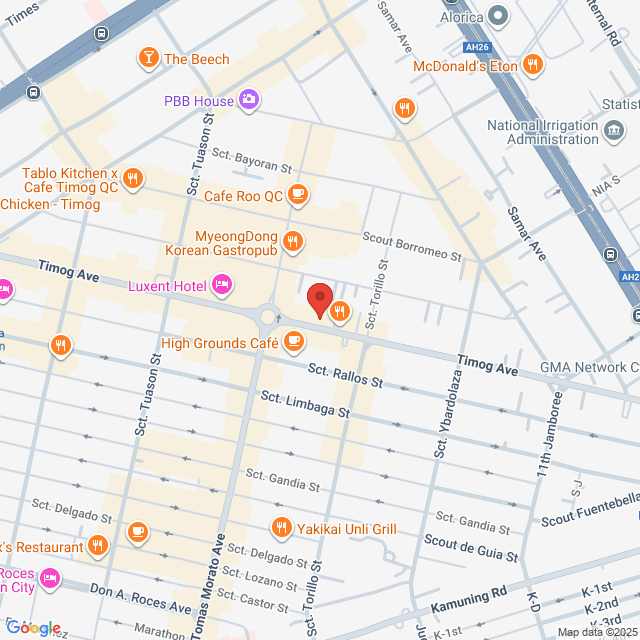

Working Location

8, Condominium South Insula. Philip, 61 Timog Ave, Diliman, Quezon City, 1103 Metro Manila, Philippines

Posted on 11 August 2025

Explore similar jobs

View more similar jobsAccounting Supervisor

Quality Choices Corporation

Quality Choices CorporationNegotiable

On-site - Quezon City3-5 Yrs ExpBachelorFull-time

Jet NavarroT.A - Lead

Accounting Staff

Maria Management Specialists Corporation

Maria Management Specialists Corporation$340-424[Monthly]

On-site - Quezon City1-3 Yrs ExpBachelorFull-time

KATE CALALOHR Officer

Accountant

Paras Garment Alter Station

Paras Garment Alter Station$306-390[Monthly]

On-site - Quezon City3-5 Yrs ExpBachelorFull-time

HR ParasHR Officer

Accountant

Premium Choice Meatshop

Premium Choice Meatshop$255-289[Monthly]

On-site - Quezon CityFresh Graduate/StudentBachelorFull-time

Melody CruzHR Officer

Fresh Grad - BS in Accountancy - CPA

Dempsey Resource Management Inc.

Dempsey Resource Management Inc.$424-509[Monthly]

On-site - Quezon CityFresh Graduate/StudentBachelorFull-time

Aisa Refugia

Bossjob Safety Reminder

If the position requires you to work overseas, please be vigilant and beware of fraud.

If you encounter an employer who has the following actions during your job search, please report it immediately

- withholds your ID,

- requires you to provide a guarantee or collects property,

- forces you to invest or raise funds,

- collects illicit benefits,

- or other illegal situations.